crypto tax calculator canada reddit

Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Any good auto-tax calculators for Canada.

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

In Canada Canadians are required to pay tax on 50 of the capital gains of any equity investment when that investment is liquidated.

. Straightforward UI which you get your crypto taxes done in seconds at no cost. Supports ATO Tax Guidelines. But remember - youll only pay tax on half your capital gain.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Unrealized Gains 275 as calculated above Net Taxable gain 1050 - 700 - 275 75. You can see the Federal Income Tax rates for the 2021 and 2022 tax years below.

In simple terms this means that Canadians need to pay capital gains tax on 50 of any cryptocurrency investment profit. Let us handle the formalities. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

On the other hand businesses can write off 100 of their losses on their income. Redirecting to httpswwwkoinlyio 308. Investors can only write off 50 of losses.

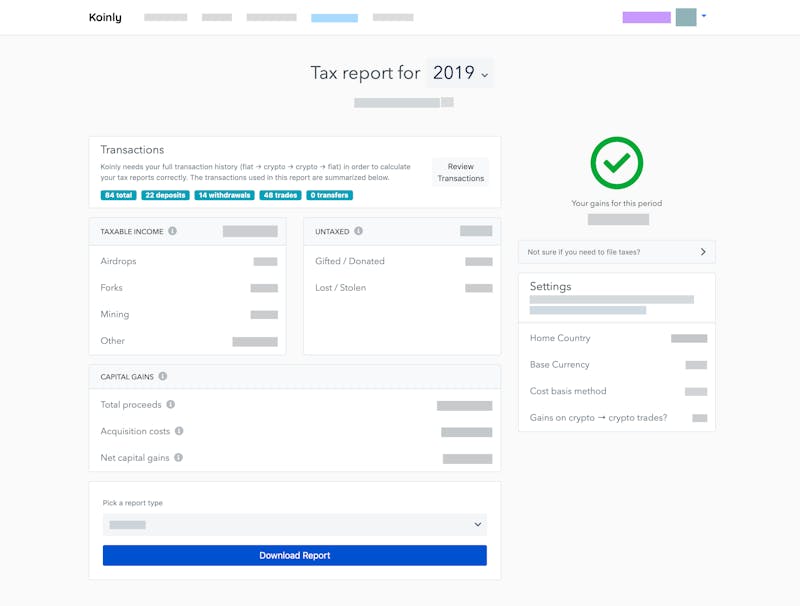

You simply import all your transaction history and export your report. Take the initial investment amount lets assume it is 1000. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Terrible spread 175 but transfer fees for ETH transfers above 01 ETH and BTC above 00001 are fully covered. Generate a full crypto tax report with all your. Crypto withdraw fees seem to be higher than other exchanges though but given the great spread and flat 499 withdraw fee this is now my preferred option for trades over 1000.

Report crypto on your taxes easily using Koinly a crypto tax calculator and software. Stay focused on markets. You can use crypto as an investment as a currency for spending or as a source of passive income.

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. This means you can get your books up to date yourself allowing you to save significant time. This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. You cannot claim a capital loss if you buy the same cryptocurrency 30 days prior to or 30 days after the sale. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Losses should nullify any need to file taxes for crypto. Canadas Superficial Loss Rule places some restrictions on writing off capital losses. Canadian Crypto Tax Reddit Community With Experts.

Use our Crypto Tax Calculator. Partnered with Aussie International Exchanges. A simple way to calculate this is to add up all your capital gains and then divide this by 2.

However it is important to note that only 50 of your capital gains are taxable. Our platform allows you to import transactions from more than 450 exchanges and blockchains today. Whatever method you use make sure you double check that everything is being calculated correctly.

The resulting number is your cost basis 10000 1000 10. National Director of Tax Services Baker Tilly Canada. Download your CRA tax documents.

Here is a proof on this using FIFO method. We offer full support in US UK Canada Australia and partial support for every other country. Would like some insight if anyone knows more thanks.

Posted by 3 years ago. Your Canadian Bitcoin and cryptocurrency tax information hosts John and Myles bring a combined 35 years of experience and a strong passion for keeping Canadian investors in the know when it comes to tax info. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains.

Paying taxes on cryptocurrency in Canada doesnt have to be a headache. Calculate and report your crypto tax for free now. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software.

I mostly just use Koinly to find the market values at the time of my transactions and to have the value of my portfolio on my phone using the Android app. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada. Lets talk about Bitcoin in Canada.

Any good auto-tax calculators for Canada. Schedule 3 Download your Schedule 3 with pre-filled figures from your crypto trades. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

Income 2021 Income 2022 15. Simply copy the numbers into your annual tax return. Op 3y.

Whether you are filing yourself using a tax software like SimpleTax or working with an accountant. Heres an example of how to calculate the cost basis of your cryptocurrency. You can discuss tax scenarios with your accountant.

Ending Balance Holding Value profits taken 600 450 1050. Starting balance Cash invested 500 200 700. You have investments to make.

Koinly can generate the right tax documents for you. Does the CRA tax crypto. How to calculate your crypto tax in Canada.

Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. While 50 of capital gains are taxable 100 of business income is taxable. Mining staking income.

50 of any gains if you have any lol are taxable. Generate complete tax reports for mining staking airdrops forks and other forms of income. Covers NFTs DeFi DEX trading.

Stop worrying about record keeping filing keeping up to date with. In this guide we outline how both categories are reported and. You simply import all your transaction history and export your report.

Capital gains tax report. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Sell off 6 x 75 units 450.

Establishing whether or not your transactions are part of a business is very important. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

How To Calculate Crypto Taxes Koinly

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Reporting Taxes In Crypto For High Volume Users

Crypto Taxes How To Video Guide Free Excel Sheet R Bitcoinca

Calculating Crypto Taxes With The Superficial Loss Rule R Bitcoinca

How To Calculate Crypto Taxes Koinly

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

Crypto Com S Free Tax Calculator R Cryptocurrency

Koinly Vs Cryptotrader Tax Compare Differences Reviews

How To Calculate Crypto Taxes Koinly

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

Cryptocurrency Tax Reports In Minutes Koinly

Crypto Tax Calculator Overview Youtube

Are Wrapped Crypto Tokens Taxable Koinly

How Fees Can Lower Your Income Tax Koinly